Content

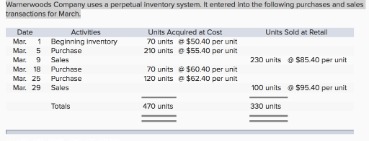

Illinois corporations are subject to Illinois’s corporate income tax, personal property replacement tax, and corporation franchise tax. Profits from S corporations “pass through” to the shareholders. The shareholders are then responsible for their personal income tax.

Illinois is known for high business taxes, with a top corporate income tax rate of 9.5%. Only Minnesota, Iowa, Pennsylvania and New Jersey have higher corporate income taxes. In addition, its state sales tax stands at 6.25%, which is higher than average.

S Corporations

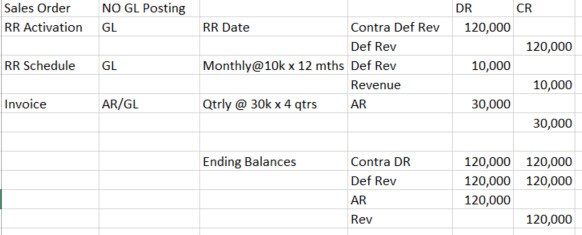

When you register for sales tax, Illinois will assign you a certain filing frequency. You’ll be asked to file and pay sales tax either monthly, quarterly, or illinois income tax rate annually. Unemployment compensation is taxed in Illinois as part of your adjusted gross income, whether you’re a resident or were employed in the state.

Businesses selling tangible personal property at retail arerequired to registerwith the Illinois Department of Revenue. If you have too many shipments to look up individually, city and county tables provide rates assessed at local levels. Married couples filing jointly with an adjusted gross income over $500,000, and all other filing statuses with AGI over $250,000, can’t claim the education expense credit. Illinois state offers a personal exemption and tax credits, such as the earned income tax credit, and education expense credit. If you need help with Illinois S corporation tax, you can post your legal need on UpCounsel’s marketplace.

Illinois S Corp Tax: Everything You Need to Know

The Town of Normal collects a 6% tax on short-term rentals. The tax is on the gross rental charge for renting a residential rental unit within the Town of Normal for less than 30 consecutive days. The Town of Normal collects a 0.75% tax on titled items sold to residents. Examples of titled items include automobiles, motorcycles and trailers.

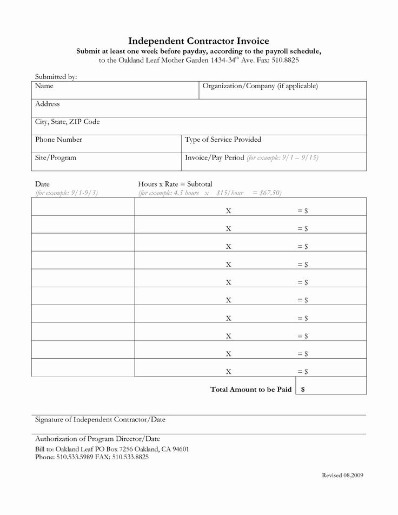

Get the fastest information, worry-free services, and expert support you need. Learn more aboutlegal compliance for small business owners. In 2014, according to the Federation of Tax Administrators, Illinois collected $39.183 billion in tax revenues. The state’s tax revenues per capita were $3,042, ranking 15th highest in the United States.

What is the Illinois Income Tax Rate?

Numerical rankings are tabulated by excluding states with no personal income tax and are based on the highest possible tax rate for which an individual might be liable. Because some states are excluded from the rankings and a few share common uppermost rates, there are 34 numerical rankings, with 1 indicating the highest uppermost rate and 34 indicating the lowest. While federal tax rates apply to every taxpayer, state income tax rates vary by state.

- Make sure you’re managing your money in the most effective way with highly rated accounting software.

- Illinois does not have a standard or itemized deduction; instead, it offers a personal exemption of $2,375 for the 2021 tax year.

- Illinois’ government has had a history of fiscal trouble, which has not gone unnoticed by the business community.

- Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your Illinois corporation is paying the correct amount, and that you’re paying the correct individual amount.

- This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

Martindale-Nolo and up to 5 participating attorneys may contact you on the number you provided for marketing purposes, discuss available services, etc. Messages may be sent using pre-recorded messages, auto-dialer or other automated technology. You are not required to provide consent as a condition of service.